Mobile Banking Explained In Fewer Than 140 Characters

Excitement About Digital Banking Solutions & Platform

Featuring a large range of tools as well as performances that cover all facets of these tasks, it is now important to efficiently operate their digital improvement. It is utilized to deal with all procedures from front and also back office for all branches of the network on multiple networks: Net system, mobile application, ATMs.

In addition to its very own modules, its open style allows link to software application from various other suppliers. No matter the type of organization, the variety of customers as well as the volume of transactions, a modern core banking system is adaptable sufficient to enable custom-made arrangements and as a result reply to any kind of particular need.

Furthermore, they are subject to the several and also strict guidelines, with possibly heavy repercussions in case of non-compliance. These pressures all market players to rely upon a powerful technical base. Many thanks to regarding twenty years of industrial task, has actually become a world-renowned online. We use comprehensive services made up of even more than 200 modules that support all tasks from back workplace to front office.

The Best Strategy To Use For Digital Banking Software Solutions - Online Banking Software

These last consequently take pleasure in a multi-channel experience, being able to accessibility all financial services on their computer system or on a mobile digital device (phone or tablet). This adds to enhance consumers' contentment as well as helps preserving them, which is essential in a situation of enhanced competition. Being a principal in the digital banking area, we are dedicated to offering banks as well as monetary institutions with modern-day, efficient, dependable and also versatile IT tools that can perfectly fulfill their requirements.

It is finished by expert assistance in any way stages of the task implementation: evaluation, integration, management, introducing as well as also after go-live. Moreover, due to evolving market conditions, our solutions are frequently being upgraded and upgraded with additional performances. 450 professionals benefit our Research and also Growth division to establish software application capable of adjusting to any type of substantial change extremely rapidly (digital solutions in banking).

is commonly renowned for its totally incorporated software that help banks in developing a remarkable multi-channel customer experience. In this age where electronic banking makeover is critical, having this software application specialist as a partner is necessary to relocate towards operational excellence and also increase their results. Adaptability is among SAB applications' greatest advantages; thus, they cover all financial company lines.

The Buzz on Digital Banking Solutions & Platform

Out of 577 special banks in the Philippines, 450 are rural financial institutions that have a bigger reach as well as spread tactically throughout the nation. However, 94% of rural financial institutions have no accessibility to an e-payment infrastructure. This indicates most Filipinos do not have the ways to obtain less complicated monetary access. Furthermore, most readily available modern technologies as well as repayment services need an upgraded phone or a good wifi link that is not included in the Filipinos' monetary habits.

The depiction of economic institutions is rapidly altering. No longer is a financial institution an organization on Wall Street but instead an application on my phone. Creating company development calls for a fast adjustment to this business model. Our services address this transformation, allowing you to embrace new organization versions and specify a modern organization style.

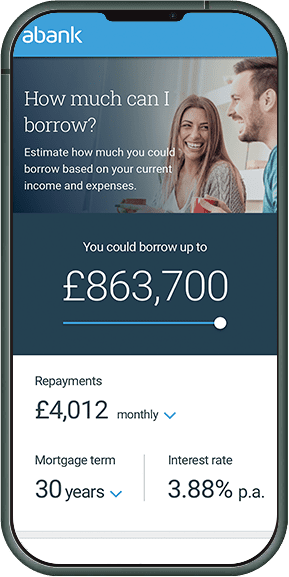

Accepting digital is a lot more than a mobile app, yet instead an omni-channel approach. You need to map every one of your client's desires as well as then fulfill them. Younger clients tend to be 'cashless' and intend to transfer cash quickly with their close friends with mobile financial. Various other customers expect individualized monetary solutions as well as suggestions via an electronic banking platform.

The Of Best Digital Banking Platform In 2020

At the heart of this is reputable and secure solutions. The line of splitting up between affordable banks, including electronic native Fintech companies, is so slim as well as obscuring more every year. Because of that, banking service manufacturers loan origination can not pay for a safety slip. Customers today will promptly move services with one safety and security scare.

Our electronic as well as application solution specialists will certainly after that make that roadmap a fact, designing and also applying brand-new electronic solutions. Our end-to-end offers will electronically transform your financial institution, managing risk as well as driving profitability.

Among the crucial points when a business releases a system whether a web site or mobile application is opening individual accounts that allow them to be utilized as purses, accelerating collections and also allowing settlements and transfers. Financial solutions Options already exist such as BBVA APIs Accounts and Home loans that mean, With the development of ecommerce and also the digitization of culture, has infected all services.

Getting The Digital Banking Solutions To Work

This digitization is transforming settlement solutions whatsoever levels of organization, from multinationals to small as well as medium-sized business to the micro-SMEs belonging to the freelance. From repayments to suppliers of product or services to settling the credit so common of standard local stores, there is currently a chance to digitize the "I'll place in on the tab" in a well organized way.

These systems help by making it simpler for promptly as well as securely - digital banking solutions companies. initially making use of bank cards and after that via mobile financial solutions has been a historical barrier to entrance. The modern technology just started to be approved by the "majorities" in the stages in the product life process (trendsetters, very early adopters, very early majority as well as late majority) when the very early adopters reported that they were safe.

This combination depends on the opening of an electronic account within BBVA's electronic framework, a significant factor in making certain protection. With this API, a firm's customers can open a digital account with low financial risk straight from that business's app or site, with no need for 3rd parties. As well as without leaving house.

The Definitive Guide to Digital Banking Solutions

Rapid, secure and also with simply a few clicks. BBVA's Accounts API assists business with the usage an API incorporated into the BBVA setting, facilitating the opening of make up clients, employees and providers with just a couple of clicks. This consists of offering individuals the possibility of connecting a debit card to the account.

When users intend to, they launch a request and also receive an SMS with an one-of-a-kind, single code, enabling them to trigger their brand-new account swiftly and safely. The agreement is sent out to the customer's e-mail automatically. The brand-new account can be provided making use of BBVA mobile financial, inquiring details of account info, seeing balances, and also checking and making motions.

Sandstone Technology Group

Level 4/123 Walker St, North Sydney NSW 2060, Australia

+61299117100

https://www.sandstone.com.au/en-au/

info@sandstone.com.au

Postal Address:

PO Box 2011, North Sydney

NSW 2059 AUSTRALIA

https://www.washingtonpost.com/newssearch/?query=digital banking