The History Of Can I Cash A Cheque

The company currently serves 65 million digital banking individuals across 30 countries. "Meniga's award winning remedy aids several retail financial institutions throughout the world create equally advantageous digital relationships with their clients by considerably boosting their online and mobile banking individual experience with innovative options developed to get people to think of and engage with their financial resources." Menage reported that its collection of items will ensure that America's traditional financial institutions can future-proof as well as enhance their offering to customers, against a growing variety of oppositions as well as innovation titans such as Apple, Amazon, Google, as well as Facebook, which are presently getting substantial shares of the market.

You can discover more information about the topic here: broker data

Given that expanding right into the Southeast Asian market just last year, we've additionally contributed in getting a few of the location's most prominent banking applications to market. By opening to the United States, we're mosting likely to be leading the fee right here also." Georg Ludviksson, CEO as well as founder of Meniga, included: "In the present economic climate, it is important that Americans are getting the support they need from their banks, and aid with the management of their individual finances.

Release a brand-new financial institution in a few months. Our white-label BaaS makes it feasible, using our EU banking license or yours. Whether you're constructing a challenger financial institution or including financial solutions to a consumer-led company, we'll assist you expand your company model right into new resources of customer fulfillment and profits.

Your consumers expect option and benefit choosing just how, when, as well as where they wish to pay their expenses. Our Settlement Entrance is an enterprise-wide option that manages your settlement handling across several channels and client payment types. It's developed to settle as well as help streamline settlement processing, transaction monitoring, reporting, and also exception handling throughout one incorporated repayment portal.

Change in core financial today is quicker than ever. Technologies like blockchain, synthetic knowledge, wheelchair, big data are progressing ... Read Extra.

Driven by strong consumer demand to access brand-new solutions anywhere at any moment, the financial sector is increasing its digital transformation. The prevalent use of smart phones additional gas this demand and also the movement from paper to digital affects all customer relationship channels. To enhance customer care, it allows financial institutions to promote their growth by enhancing processes, mostly through removing paper as well as lowering both distribution time as well as prices.

IDEMIA's identification and also trust fund services platform can be used to deploy countless applications, consisting of new client electronic onboarding, sensitive procedure approval (transfer orders, repayments), safe and secure multichannel cash money management (SWIFTNet/FileAct, EBICS), authentication for online payments, multichannel online contracting for all sorts of economic products (lendings, savings, life insurance coverage).

"We are delighted about the new Lumin Digital system, and I believe after you hear a lot more regarding it that you as well will certainly share in the excitement. Using a mini service architecture you'll locate a more active growth setting, allowing you faster to market plugins and also attributes that in the past took months can currently take days." Kevin Wright, CIO CFE Federal Cooperative Credit Union.

Oracle Banking Digital Experience is an enterprise-class, open, cloud-ready, scalable, electronic banking service. Banks can quickly provide digital capabilities without changing their existing core financial systems. A single platform for financial institutions to deliver engaging digital experiences throughout all channels Solutions all line of work, consisting of retail, SME, company, as well as Islamic all at once A very extensible and personalized remedy capable of integrating with any type of existing modern technology landscape.

Produce a supplier selection project & run comparison reports Click to express your passion in this record Indication of protection versus your demands A membership is called for to activate this attribute. Contact us for even more details. Celent have evaluated this account and also think it to be precise.

It is no shock that cloud-native core banking has expanded in appeal as a lot as it has, as its appeal as well as assurance use newly found versatility for banks from conserving money and time to improving agility and also scalability. The main essential differences are: In an on-premise environment, resources are released in-house and within your bank's IT facilities.

In the cloud, resources are organized on the premises of a provider. Nevertheless, you have the ability to gain access to those sources and also use them at any type of provided time. There are no capital spending and also data can be supported regularly. It enables you to get in touch with clients, partners, and also other companies with minimal initiative.

When you utilize a cloud-native model, you just need to pay a fixed fee to the SaaS service provider. It provides you the capability to reduce system upkeep prices, which decreases heritage innovation worries. This allows you to invest spending plans on advancement, client contentment as well as growing the organization.

In today's hyper-competitive market, banks need a technology companion that can not only deliver innovative electronic financial customer experiences yet also has a clear vision of where their limited dollars require to be invested to prosper. We have actually developed a complete collection of digital financial remedies throughout profession financing, loaning, as well as channel solutions and provided over 75 electronic improvement programs worldwide.

Consulting Providers: Assess electronic maturity as well as style a solution roadmap that makes you prepared for the electronic future. Mobile Banking: Release MyBank, a next-generation mobile financial service that permits the reuse of customer info that makes it possible for frictionless transactions and also an enhanced electronic experience. Digital Marketing: Capacity to micro-segment clients making it possible for customization of offers.

API Banking: Reduce time-to-market as well as improve the customer experience via cutting-edge solutions that aid clients link to the market. Additionally, calculated partnerships with leading item firms such as Adobe, and also IBM API Connect make us a companion of choice for banks that need to take their digital banking programs to the next level of maturity.

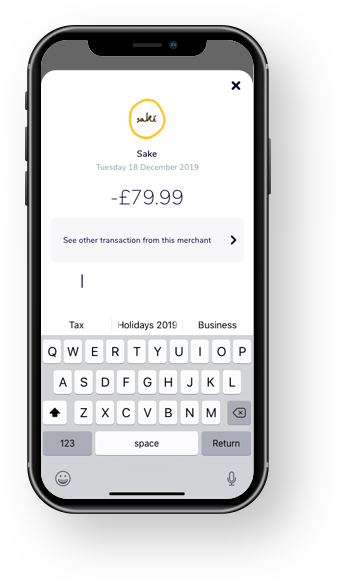

In electronic financial, individual money monitoring (PFM) is a crucial contributor to customer interaction. If you can be the go-to location for clients to handle their finances, that can quickly develop into enhanced commitment as well as sales. With Tink's PFM SDKs, making PFM occur doesn't require to be a large task.

Sandstone Technology Group

Level 4/123 Walker St, North Sydney NSW 2060, Australia

61299117100

https://www.sandstone.com.au/en-au/

info@sandstone.com.au

Postal Address:

PO Box 2011, North Sydney

NSW 2059 AUSTRALIA

11 Ways To Completely Ruin Your Broker Data

The business currently serves 65 million digital banking users across 30 nations. "Meniga's award winning service aids several retail financial institutions across the world produce equally helpful digital partnerships with their consumers by considerably enhancing their online as well as mobile banking individual experience through cutting-edge options developed to get individuals to think of and also engage with their financial resources." Menage reported that its suite of items will certainly ensure that America's traditional banks can future-proof and enhance their offering to clients, versus an expanding number of oppositions as well as technology titans such as Apple, Amazon.com, Google, and also Facebook, which are presently ordering significant shares of the marketplace.

You can find more info about the topic here: broker data

Because expanding right into the Southeast Eastern market just in 2014, we've also contributed in getting a few of the area's most prominent financial applications to market. By opening to the United States, we're going to be leading the cost here too." Georg Ludviksson, CEO as well as co-founder of Meniga, added: "In the current financial climate, it is essential that Americans are obtaining the assistance they need from their banks, and also aid with the administration of their individual finances.

Introduce a new financial institution in a few months. Our white-label BaaS makes it feasible, utilizing our EU banking permit or your own. Whether you're developing a challenger financial institution or adding banking services to a consumer-led organization, we'll aid you expand your service model into brand-new sources of consumer contentment as well as earnings.

Your customers expect choice and also convenience picking exactly how, when, as well as where they intend to pay their bills. Our Settlement Entrance is an enterprise-wide solution that handles your settlement handling throughout several channels and client settlement kinds. It's created to settle as well as assist streamline repayment handling, transaction tracking, reporting, and also exemption processing throughout one integrated payment site.

Makeover in core financial today is quicker than ever before. Technologies like blockchain, synthetic knowledge, wheelchair, big data are evolving ... Find out more.

Driven by solid customer need to access new services anywhere any time, the financial market is accelerating its electronic makeover. The prevalent use mobile devices more fuels this need and the movement from paper to electronic impacts all customer partnership channels. To boost customer care, it permits banks to boost their growth by enhancing procedures, mainly via eliminating paper and decreasing both delivery time and costs.

IDEMIA's identification and trust fund solutions system can be used to deploy numerous applications, including brand-new consumer digital onboarding, sensitive operation approval (transfer orders, settlements), safe and secure multichannel cash money administration (SWIFTNet/FileAct, EBICS), verification for online settlements, multichannel online having for all kinds of financial products (financings, financial savings, life insurance policy).

"We are delighted about the brand-new Lumin Digital system, and also I think after you listen to extra concerning it that you too will cooperate the enjoyment. Using a mini solution style you'll discover a much more agile advancement setting, permitting you faster to market plugins and also attributes that in the past took months can currently take days." Kevin Wright, CIO CFE Federal Lending Institution.

Oracle Banking Digital Experience is an enterprise-class, open, cloud-ready, scalable, digital financial solution. Financial institutions can rapidly deliver electronic abilities without altering their existing core banking platforms. A single system for banks to supply engaging digital experiences throughout all channels Services all line of work, including retail, SME, corporate, as well as Islamic all at once A highly extensible as well as customizable option qualified of incorporating with any type of existing modern technology landscape.

Develop a supplier option job & run contrast reports Click to reveal your interest in this report Indication of coverage versus your demands A subscription is needed to trigger this attribute. Contact us for even more details. Celent have reviewed this account and also believe it to be accurate.

It is no shock that cloud-native core financial has expanded in popularity as long as it has, as its allure as well as pledge provide newly found adaptability for financial institutions from saving time and also money to boosting dexterity as well as scalability. The main vital differences are: In an on-premise environment, resources are released internal as well as within your financial institution's IT framework.

In the cloud, resources are held on the facilities of a service company. However, you are able to accessibility those resources and also utilize them at any provided time. There are no funding expenditures and also data can be supported frequently. It allows you to connect with consumers, companions, and various other organizations with marginal initiative.

When you make use of a cloud-native version, you just need to pay a fixed fee to the SaaS supplier. It supplies you the capacity to lower system maintenance costs, which decreases heritage innovation fears. This enables you to invest budget plans on development, consumer complete satisfaction and growing the business.

In today's hyper-competitive market, banks require an innovation companion that can not just deliver innovative digital banking customer experiences however also has a clear vision of where their limited bucks need to be spent to be successful. We have actually developed a complete suite of digital banking solutions throughout trade finance, lending, and also channel solutions as well as delivered over 75 electronic transformation programs worldwide.

Consulting Services: Examine electronic maturity and design a service roadmap that makes you all set for the electronic future. Mobile Banking: Deploy MyBank, a next-generation mobile banking remedy that allows the reuse of consumer details that enables frictionless transactions and also an improved digital experience. Digital Marketing: Capability to micro-segment customers making it possible for customization of offers.

API Financial: Decrease time-to-market and enhance the client experience with ingenious services that assist clients attach to the market. In addition, calculated collaborations with leading item companies such as Adobe, and IBM API Connect make us a partner of selection for banks that require to take their digital financial programs to the following level of maturation.

In digital banking, individual finance administration (PFM) is a key contributor to customer engagement. If you can be the go-to area for clients to handle their financial resources, that can quickly become raised commitment and also sales. With Tink's PFM SDKs, making PFM occur doesn't need to be a large task.

Sandstone Technology Group

Level 4/123 Walker St, North Sydney NSW 2060, Australia

61299117100

https://www.sandstone.com.au/en-au/

info@sandstone.com.au

Postal Address:

PO Box 2011, North Sydney

NSW 2059 AUSTRALIA

20 Up-and-comers To Watch In The .Cda Industry

The company presently serves 65 million electronic financial users throughout 30 nations. "Meniga's award winning remedy assists numerous retail financial institutions throughout the globe produce equally helpful digital connections with their customers by dramatically boosting their online and mobile financial individual experience through innovative remedies developed to get people to think of as well as engage with their finances." Menage reported that its collection of items will ensure that America's traditional financial institutions can future-proof as well as enhance their offering to customers, against an expanding number of challengers and technology titans such as Apple, Amazon.com, Google, and Facebook, which are currently getting significant shares of the market.

You can discover more info about the subject here: broker data

Since broadening into the Southeast Asian market just in 2014, we've also been critical in getting some of the area's most prominent banking applications to market. By opening to the US, we're mosting likely to be leading the cost here also." Georg Ludviksson, CEO as well as co-founder of Meniga, added: "In the current economic environment, it is essential that Americans are getting the support they need from their banks, and aid with the management of their individual funds.

Release a new financial institution in a couple of months. Our white-label BaaS makes it possible, utilizing our EU financial permit or your own. Whether you're building a challenger bank or including financial services to a consumer-led organization, we'll help you increase your company version right into new sources of customer contentment and also earnings.

Your customers expect option and also ease picking how, when, and also where they want to pay their expenses. Our Payment Gateway is an enterprise-wide solution that handles your repayment handling across several networks and consumer settlement kinds. It's developed to settle as well as help streamline settlement handling, transaction tracking, reporting, and also exemption processing all through one integrated repayment website.

Transformation in core banking today is faster than ever before. Technologies like blockchain, expert system, mobility, huge information are evolving ... Learn more.

Driven by strong consumer need to access new services anywhere any time, the banking industry is increasing its digital makeover. The widespread use of mobile phones more gas this demand and the movement from paper to digital influences all customer connection networks. To improve customer care, it permits banks to promote their growth by optimizing processes, mostly through removing paper and also lowering both delivery time and also expenses.

IDEMIA's identification and also count on solutions platform can be used to deploy many applications, consisting of new consumer electronic onboarding, sensitive operation authorization (transfer orders, payments), safe multichannel money management (SWIFTNet/FileAct, EBICS), verification for on the internet repayments, multichannel online having for all types of financial products (finances, savings, life insurance).

"We are thrilled concerning the new Lumin Digital system, and also I believe after you hear much more concerning it that you too will cooperate the excitement. Using a micro service design you'll discover an extra agile development setting, permitting you faster to market plugins and attributes that in the previous took months can now take days." Kevin Wright, CIO CFE Federal Credit Report Union.

Oracle Financial Digital Experience is an enterprise-class, open, cloud-ready, scalable, electronic financial service. Financial institutions can rapidly supply electronic capacities without transforming their existing core financial platforms. A single platform for financial institutions to provide interesting electronic experiences throughout all networks Providers all lines of organizations, including retail, SME, corporate, and also Islamic concurrently A highly extensible and personalized remedy efficient in integrating with any existing modern technology landscape.

Create a vendor selection project & run contrast records Click to share your passion in this report Sign of insurance coverage versus your requirements A membership is required to activate this function. Call us for more info. Celent have evaluated this profile and also think it to be precise.

It is no shock that cloud-native core banking has expanded in popularity as high as it has, as its allure as well as pledge use newfound flexibility for financial institutions from saving time and money to boosting agility and also scalability. The main crucial distinctions are: In an on-premise setting, sources are released in-house and also within your financial institution's IT infrastructure.

In the cloud, sources are hosted on the premises of a company. Nonetheless, you have the ability to gain access to those resources and use them at any type of offered time. There are no funding costs and also data can be supported consistently. It permits you to get in touch with clients, partners, as well as various other services with minimal effort.

When you use a cloud-native version, you just need to pay a fixed fee to the SaaS provider. It uses you the capability to minimize system maintenance expenses, which decreases tradition technology worries. This permits you to invest budget plans on technology, client fulfillment and growing business.

In today's hyper-competitive market, banks require an innovation partner that can not only deliver innovative electronic financial consumer experiences yet additionally has a clear vision of where their limited dollars require to be invested to do well. We have established a full collection of digital banking solutions throughout trade finance, financing, and also network solutions as well as delivered over 75 electronic makeover programs worldwide.

Consulting Solutions: Evaluate digital maturity and style a remedy roadmap that makes you prepared for the digital future. Mobile Banking: Deploy MyBank, a next-generation mobile banking solution that permits the reuse of customer details that makes it possible for smooth purchases and an enhanced digital experience. Digital Marketing: Capability to micro-segment consumers enabling customization of offers.

API Banking: Reduce time-to-market as well as improve the client experience with ingenious remedies that aid consumers link to the industry. Additionally, calculated collaborations with leading item companies such as Adobe, and also IBM API Connect make us a partner of option for financial institutions that require to take their electronic financial programs to the following degree of maturity.

In digital banking, individual finance administration (PFM) is a vital contributor to customer involvement. If you can be the best area for clients to handle their financial resources, that can conveniently develop into enhanced loyalty as well as sales. With Tink's PFM SDKs, making PFM happen doesn't need to be a massive endeavor.

Sandstone Technology Group

Level 4/123 Walker St, North Sydney NSW 2060, Australia

61299117100

https://www.sandstone.com.au/en-au/

info@sandstone.com.au

Postal Address:

PO Box 2011, North Sydney

NSW 2059 AUSTRALIA

![]()

12 Companies Leading The Way In Nab App Fingerprint

The company currently offers 65 million electronic banking users throughout 30 nations. "Meniga's honor winning service assists numerous retail financial institutions across the world create mutually valuable electronic partnerships with their consumers by dramatically boosting their online and also mobile banking customer experience through innovative options developed to get people to consider and also engage with their financial resources." Menage reported that its collection of products will certainly ensure that America's traditional banks can future-proof and also enhance their offering to clients, against a growing number of challengers as well as technology giants such as Apple, Amazon, Google, and Facebook, which are currently ordering considerable shares of the market.

You can discover more info about the subject here: broker data

Given that increasing into the Southeast Oriental market simply in 2014, we've likewise contributed in obtaining some of the area's most prominent banking applications to market. By opening up to the US, we're mosting likely to be leading the charge below also." Georg Ludviksson, Chief Executive Officer and co-founder of Meniga, added: "In the current financial climate, it is essential that Americans are obtaining the assistance they require from their financial institutions, as well as assist with the monitoring of their personal funds.

Launch a brand-new financial institution in a couple of months. Our white-label BaaS makes it feasible, utilizing our EU financial certificate or yours. Whether you're developing a challenger bank or adding financial solutions to a consumer-led organization, we'll help you expand your business version right into new sources of client contentment and also revenue.

Your clients anticipate selection as well as benefit finding just how, when, and where they intend to pay their bills. Our Repayment Portal is an enterprise-wide option that manages your repayment handling across several networks and consumer repayment types. It's designed to combine as well as aid streamline payment processing, transaction monitoring, reporting, as well as exception handling all with one incorporated repayment portal.

Improvement in core financial today is faster than ever before. Technologies like blockchain, man-made intelligence, wheelchair, large information are developing ... Read Much more.

Driven by solid customer demand to access new solutions anywhere any time, the banking sector is increasing its digital change. The widespread use of mobile phones additional fuels this demand as well as the migration from paper to electronic affects all client connection channels. To enhance customer care, it permits financial institutions to promote their development by enhancing processes, generally via getting rid of paper and reducing both distribution time as well as prices.

IDEMIA's identification and trust fund services system can be used to release countless applications, including brand-new client digital onboarding, sensitive procedure authorization (transfer orders, settlements), safe multichannel money administration (SWIFTNet/FileAct, EBICS), authentication for online settlements, multichannel online having for all sorts of monetary items (finances, cost savings, life insurance).

"We are thrilled regarding the new Lumin Digital platform, and I believe after you hear more regarding it that you also will certainly cooperate the excitement. Using a mini service style you'll discover a much more active advancement environment, enabling you faster to market plugins and also functions that in the previous took months can now take days." Kevin Wright, CIO CFE Federal Credit Scores Union.

Oracle Banking Digital Experience is an enterprise-class, open, cloud-ready, scalable, digital financial option. Banks can swiftly supply electronic capacities without altering their existing core financial platforms. A single platform for banks to provide appealing digital experiences across all networks Solutions all line of work, including retail, SME, company, and also Islamic simultaneously A highly extensible as well as personalized service with the ability of incorporating with any existing modern technology landscape.

Create a supplier option job & run comparison reports Click to share your passion in this record Indication of coverage against your requirements A subscription is called for to activate this feature. Get in touch with us for even more details. Celent have actually evaluated this profile and think it to be precise.

It is not a surprise that cloud-native core financial has actually expanded in appeal as long as it has, as its appeal as well as pledge supply newly found adaptability for banks from saving money and time to boosting agility as well as scalability. The main key distinctions are: In an on-premise environment, resources are deployed internal and also within your financial institution's IT facilities.

In the cloud, sources are organized on the facilities of a company. Nonetheless, you have the ability to gain access to those sources and also use them at any type of provided time. There are no capital expenditure as well as information can be supported on a regular basis. It allows you to get in touch with customers, companions, and other services with very little initiative.

When you make use of a cloud-native version, you just need to pay a fixed charge to the SaaS company. It provides you the capability to minimize system upkeep expenses, which lowers heritage innovation concerns. This enables you to spend budgets on technology, client contentment and expanding the service.

In today's hyper-competitive market, financial institutions require a technology companion that can not only deliver cutting-edge digital banking client experiences yet also has a clear vision of where their minimal dollars need to be spent to be successful. We have actually created a complete suite of electronic financial solutions throughout profession finance, loaning, and also network solutions and supplied over 75 electronic improvement programs worldwide.

Consulting Solutions: Assess electronic maturity and also layout a remedy roadmap that makes you all set for the electronic future. Mobile Financial: Deploy MyBank, a next-generation mobile financial solution that permits the reuse of client info that enables frictionless purchases and an enhanced digital experience. Digital Marketing: Capability to micro-segment clients making it possible for personalization of offers.

API Banking: Lower time-to-market and also enhance the consumer experience with ingenious remedies that aid clients attach to the industry. Furthermore, critical collaborations with leading product companies such as Adobe, and IBM API Connect make us a companion of option for banks that need to take their electronic financial programs to the following level of maturity.

In digital banking, individual finance administration (PFM) is a crucial factor to consumer engagement. If you can be the go-to area for clients to manage their funds, that can conveniently transform into boosted loyalty as well as sales. With Tink's PFM SDKs, making PFM take place doesn't require to be an enormous undertaking.

Sandstone Technology Group

Level 4/123 Walker St, North Sydney NSW 2060, Australia

61299117100

https://www.sandstone.com.au/en-au/

info@sandstone.com.au

Postal Address:

PO Box 2011, North Sydney

NSW 2059 AUSTRALIA

Your Worst Nightmare About Computer Banks Come To Life

The earliest types of electronic banking trace back to the development of Atm machines as well as cards introduced in the 1960s. As the internet emerged in the 1980s with very early broadband, electronic networks started to attach merchants with suppliers and customers to create needs for early on the internet brochures and also stock software application systems.

The improvement of broadband as well as ecommerce systems in the very early 2000s caused what looked like the modern-day digital financial world today. The spreading of smart devices through the next years opened the door for deals on the go past Automated Teller Machine. Over 60% of consumers currently use their smart devices as the recommended approach for electronic financial.

This vibrant forms the basis of consumer complete satisfaction, which can be supported with Consumer Connection Monitoring (CRM) software program. Consequently, CRM needs to be integrated right into an electronic banking system, since it offers methods for financial institutions to directly communicate with their consumers. There is a need for end-to-end consistency and for solutions, enhanced on convenience as well as customer experience.

In order for banks to meet customer demands, they need to keep concentrating on improving electronic innovation that gives agility, scalability and effectiveness. A study performed in 2015 revealed that 47% of lenders see possible to enhance consumer relationship with electronic banking, 44% see it as a way to generate affordable advantage, 32% as a network for new consumer procurement.

Major benefits of digital financial are: Organization effectiveness - Not only do electronic platforms boost interaction with clients and also provide their demands faster, they additionally offer methods for making internal functions extra efficient. While banks have actually gone to the leading edge of digital modern technology at the customer end for decades, they have not completely accepted all the benefits of middleware to increase efficiency.

Standard bank handling is costly, slow-moving and also prone to human mistake, according to McKinsey & Company. Counting on people and paper also uses up office room, which adds energy as well as storage space prices. Digital systems can future decrease costs through the harmonies of more qualitative information and faster feedback to market adjustments.

Combined with absence of IT combination between branch and also back office workers, this issue minimizes business efficiency. By streamlining the verification procedure, it's much easier to execute IT remedies with service software, resulting in even more accurate audit. Financial precision is important for financial institutions to abide by federal government guidelines. Enhanced competition - Digital services assist handle advertising lists, allowing financial institutions to get to broader markets and also construct closer partnerships with technology wise consumers.

It's effective for executing customer incentives programs that can improve commitment and fulfillment. Greater dexterity - The usage of automation can quicken both outside and also inner processes, both of which can enhance client satisfaction. Adhering to the collapse of monetary markets in 2008, an enhanced emphasis was positioned on danger management.

Enhanced security - All businesses big or little face an expanding variety of cyber risks that can harm credibilities. In February 2016 the Irs revealed it had been hacked the previous year, as did a number of big technology firms. Banks can gain from added layers of security to protect information.

By replacing hands-on back-office procedures with automated software program services, banks can decrease worker mistakes as well as accelerate procedures. This standard shift can cause smaller sized operational systems and also permit managers to concentrate on boosting tasks that call for human treatment. Automation decreases the demand for paper, which inevitably ends up occupying room that can be occupied with technology.

One method a financial institution can improve its back end business effectiveness is to split numerous procedures right into three groups: complete computerized partly automated hands-on tasks It still isn't practical to automate all operations for several financial firms, specifically those that carry out monetary reviews or give financial investment advice. However the even more a financial institution can change troublesome redundant handbook tasks with automation, the a lot more it can concentrate on concerns that entail straight communication with clients.

Additionally, electronic cash can be mapped and also made up extra accurately in situations of disagreements. As consumers locate a raising variety of purchasing chances at their fingertips, there is much less requirement to carry physical money in their wallets. Various other indicators that demand for digital cash money is growing are highlighted by the use peer-to-peer repayment systems such as PayPal and the rise of untraceable cryptocurrencies such as bitcoin.

The trouble is this innovation is still not omnipresent. Cash money circulation grew in the USA by 42% in between 2007 as well as 2012, with an average yearly growth price of 7%, according to the BBC. The idea of an all electronic cash money economy is no longer simply an advanced desire but it's still not likely to date physical money in the close to future.

Atm machines assist financial institutions reduce overhanging, specifically if they are offered at numerous critical areas beyond branch offices. Arising forms of electronic banking are These services develop on enhanced technical designs along with different service versions. The decision for banks to add more digital options at all operational degrees will certainly have a major influence on their monetary stability.

Sharma, Gaurav. " What is Digital Banking?". VentureSkies. Recovered 1 May 2017. Kelman, James (2016 ). The History of Banking: An Extensive Recommendation Resource & Guide. CreateSpace Independent Posting Platform. ISBN 978-1523248926. Locke, Clayton. " The irresistible rise of electronic banking". Financial Modern technology. Obtained 9 May 2017. Ginovsky, John. " What really is "electronic financial"? Agreement on this oft-used term's meaning thwarts".

Recovered 9 May 2017. Dias, Joao; Patnaik, Debasish; Scopa, Enrico; van Bommel, Edwin. " Automating the financial institution's back office". McKinsey & Business. Retrieved 9 May 2017. Eveleth, Rose. " Will pay disappear? Many innovation supporters think so, however as Rose Eveleth finds, the truth is extra complex". BBC. Retrieved 9 May 2017.

Our cloud based service incorporates sector leading safety and security, decreasing your costs as well as offering you assurance. This solitary system advertises organic development with our vast collection of open APIs, attribute rich performance and extensive reporting capacities.

You can find more info about the topic here: Additional info

Sandstone Technology Group

Level 4/123 Walker St,

North Sydney NSW 2060, Australia

+61299117100

https://www.sandstone.com.au/en-au/

info@sandstone.com.au

Postal Address:

PO Box 2011, North Sydney

NSW 2059 AUSTRALIA

10 Things Your Competitors Can Teach You About Digital Lending Solutions

The earliest kinds of electronic financial trace back to the development of ATMs as well as cards released in the 1960s. As the internet emerged in the 1980s with early broadband, electronic networks started to connect sellers with providers and also customers to establish needs for early online catalogues and also supply software systems.

The improvement of broadband as well as ecommerce systems in the early 2000s led to what resembled the modern electronic financial world today. The expansion of smartphones via the following years opened the door for purchases on the go beyond ATM makers. Over 60% of customers now use their mobile phones as the favored method for digital banking.

This vibrant forms the basis of consumer complete satisfaction, which can be supported with Consumer Connection Management (CRM) software. Therefore, CRM needs to be integrated right into an electronic banking system, given that it gives ways for financial institutions to straight communicate with their customers. There is a need for end-to-end uniformity and also for services, optimized on convenience and customer experience.

In order for banks to fulfill consumer needs, they need to maintain concentrating on boosting digital technology that gives dexterity, scalability and effectiveness. A research study conducted in 2015 disclosed that 47% of bankers see potential to enhance consumer relationship via digital banking, 44% see it as a method to produce affordable benefit, 32% as a channel for brand-new client purchase.

Significant benefits of digital financial are: Company efficiency - Not only do electronic platforms boost interaction with clients as well as supply their needs extra rapidly, they also provide techniques for making interior functions extra effective. While financial institutions have actually gone to the center of electronic modern technology at the customer end for decades, they have not totally welcomed all the benefits of middleware to accelerate productivity.

Standard bank processing is costly, slow-moving and also vulnerable to human error, according to McKinsey & Company. Depending on people as well as paper also occupies workplace space, which adds energy and storage space costs. Digital platforms can future lower prices via the synergies of more qualitative data and faster response to market modifications.

Coupled with absence of IT integration in between branch as well as back workplace workers, this problem minimizes service effectiveness. By streamlining the confirmation process, it's less complicated to implement IT options with company software program, causing more exact audit. Financial precision is crucial for banks to comply with federal government laws. Improved competitiveness - Digital solutions assist manage advertising checklists, permitting financial institutions to reach broader markets and develop closer relationships with technology smart consumers.

It's efficient for executing consumer benefits programs that can enhance commitment as well as complete satisfaction. Greater dexterity - Using automation can speed up both outside and interior procedures, both of which can enhance customer complete satisfaction. Following the collapse of economic markets in 2008, an enhanced emphasis was positioned on risk management.

Boosted safety and security - All services large or little face an expanding variety of cyber threats that can damage reputations. In February 2016 the Irs announced it had been hacked the previous year, as did numerous huge tech business. Financial institutions can take advantage of added layers of safety to secure data.

By replacing hand-operated back-office treatments with automated software solutions, financial institutions can reduce employee mistakes and also quicken processes. This standard shift can lead to smaller operational devices and also enable supervisors to focus on boosting jobs that require human intervention. Automation minimizes the requirement for paper, which undoubtedly winds up using up space that can be inhabited with innovation.

One method a bank can improve its backside organization effectiveness is to separate hundreds of procedures into three groups: complete computerized partially automated hand-operated jobs It still isn't practical to automate all procedures for numerous financial companies, particularly those that perform monetary evaluations or give investment advice. Yet the even more a financial institution can change troublesome repetitive guidebook jobs with automation, the more it can concentrate on issues that include direct communication with consumers.

Furthermore, electronic money can be traced and also accounted for much more properly in cases of conflicts. As customers locate an enhancing number of purchasing chances at their fingertips, there is much less need to lug physical money in their wallets. Other indications that require for digital cash money is growing are highlighted by the use of peer-to-peer repayment systems such as PayPal and also the rise of untraceable cryptocurrencies such as bitcoin.

The trouble is this technology is still not universal. Cash blood circulation grew in the USA by 42% between 2007 and also 2012, with an ordinary annual development rate of 7%, according to the BBC. The idea of an all electronic money economic situation is no much longer just an advanced dream however it's still not likely to date physical money in the future.

ATMs aid financial institutions cut above, particularly if they are available at numerous strategic places past branch workplaces. Emerging kinds of digital banking are These solutions improve boosted technical designs along with different company designs. The choice for financial institutions to include even more digital solutions whatsoever functional levels will have a major effect on their economic security.

Sharma, Gaurav. " What is Digital Financial?". VentureSkies. Obtained 1 May 2017. Kelman, James (2016 ). The Background of Financial: A Detailed Recommendation Source & Guide. CreateSpace Independent Posting Platform. ISBN 978-1523248926. Locke, Clayton. " The irresistible increase of electronic financial". Financial Technology. Gotten 9 May 2017. Ginovsky, John. " What actually is "electronic financial"? Consensus on this oft-used term's definition avoids".

Recovered 9 May 2017. Dias, Joao; Patnaik, Debasish; Scopa, Enrico; van Bommel, Edwin. " Automating the financial institution's back office". McKinsey & Business. Obtained 9 May 2017. Eveleth, Rose. " Will cash go away? Numerous modern technology cheerleaders think so, however as Rose Eveleth discovers, the fact is much more challenging". BBC. Fetched 9 May 2017.

Our cloud based service integrates industry prominent safety and security, minimizing your expenditures and also providing you comfort. This single system advertises organic development through our huge library of open APIs, feature rich capability and also considerable reporting capacities.

You can find more information about the topic here: Additional info

Sandstone Technology Group

Level 4/123 Walker St,

North Sydney NSW 2060, Australia

+61299117100

https://www.sandstone.com.au/en-au/

info@sandstone.com.au

Postal Address:

PO Box 2011, North Sydney

NSW 2059 AUSTRALIA

7 Things About Transact-online Your Boss Wants To Know

The earliest types of digital banking trace back to the arrival of Atm machines as well as cards introduced in the 1960s. As the net emerged in the 1980s with very early broadband, digital networks started to connect sellers with suppliers and consumers to establish needs for very early on the internet catalogues and inventory software application systems.

The improvement of broadband and ecommerce systems in the early 2000s resulted in what appeared like the contemporary electronic banking world today. The spreading of smart devices via the following decade unlocked for transactions on the go beyond Automated Teller Machine. Over 60% of customers currently use their smartphones as the favored approach for digital financial.

This dynamic shapes the basis of client complete satisfaction, which can be supported with Customer Partnership Administration (CRM) software program. Therefore, CRM needs to be incorporated right into an electronic banking system, considering that it offers means for banks to directly communicate with their customers. There is a need for end-to-end uniformity as well as for solutions, enhanced on ease as well as customer experience.

In order for financial institutions to fulfill customer needs, they need to maintain focusing on boosting digital modern technology that supplies agility, scalability and effectiveness. A study performed in 2015 revealed that 47% of bankers see prospective to enhance client connection through digital financial, 44% see it as a way to create affordable benefit, 32% as a network for brand-new customer acquisition.

Significant advantages of digital banking are: Company effectiveness - Not only do digital systems improve communication with consumers as well as provide their requirements faster, they additionally provide techniques for making interior features much more effective. While banks have actually gone to the center of electronic modern technology at the customer end for decades, they have not completely welcomed all the benefits of middleware to increase performance.

Typical bank handling is costly, sluggish and also vulnerable to human error, according to McKinsey & Company. Relying on people and also paper likewise takes up workplace room, which runs up power as well as storage prices. Digital platforms can future minimize costs with the harmonies of even more qualitative data and also faster action to market changes.

Combined with absence of IT assimilation in between branch and back workplace personnel, this issue decreases company effectiveness. By streamlining the confirmation procedure, it's simpler to apply IT services with company software program, bring about even more accurate audit. Financial accuracy is essential for financial institutions to adhere to federal government policies. Boosted competitiveness - Digital options help manage advertising and marketing lists, enabling financial institutions to reach broader markets and build closer partnerships with tech smart customers.

It's effective for executing customer incentives programs that can boost commitment and complete satisfaction. Greater dexterity - The usage of automation can accelerate both outside and also interior processes, both of which can enhance customer satisfaction. Complying with the collapse of monetary markets in 2008, a boosted focus was positioned on danger monitoring.

Boosted security - All businesses big or tiny face an expanding number of cyber threats that can harm reputations. In February 2016 the Irs introduced it had actually been hacked the previous year, as did several huge tech firms. Financial institutions can gain from extra layers of security to shield data.

By changing hand-operated back-office procedures with automated software application services, banks can decrease worker errors and quicken procedures. This paradigm change can result in smaller sized functional units as well as permit managers to focus on enhancing tasks that call for human treatment. Automation lowers the requirement for paper, which certainly winds up using up space that can be occupied with innovation.

One means a bank can boost its backside organization effectiveness is to split thousands of processes right into 3 categories: full computerized partially automated manual jobs It still isn't sensible to automate all operations for many financial companies, particularly those that perform financial evaluations or provide financial investment advice. Yet the more a bank can change difficult repetitive handbook tasks with automation, the a lot more it can concentrate on concerns that entail direct communication with consumers.

In addition, electronic cash money can be mapped and also accounted for much more accurately in cases of disputes. As customers discover an increasing variety of buying opportunities at their fingertips, there is less requirement to bring physical money in their purses. Other signs that demand for electronic cash is expanding are highlighted by the usage of peer-to-peer repayment systems such as PayPal as well as the increase of untraceable cryptocurrencies such as bitcoin.

The trouble is this technology is still not universal. Cash flow grew in the USA by 42% in between 2007 and 2012, with a typical yearly development rate of 7%, according to the BBC. The concept of an all electronic money economic climate is no much longer simply a futuristic dream however it's still not likely to obsolete physical money in the future.

ATMs aid financial institutions cut overhead, especially if they are offered at numerous critical places beyond branch workplaces. Emerging kinds of electronic banking are These solutions develop on enhanced technical architectures as well as different organization models. The choice for financial institutions to add even more digital solutions whatsoever operational degrees will certainly have a significant influence on their financial stability.

Sharma, Gaurav. " What is Digital Financial?". VentureSkies. Obtained 1 May 2017. Kelman, James (2016 ). The History of Financial: A Thorough Reference Source & Overview. CreateSpace Independent Publishing System. ISBN 978-1523248926. Locke, Clayton. " The tempting increase of electronic banking". Banking Innovation. Obtained 9 May 2017. Ginovsky, John. " What truly is "electronic banking"? Agreement on this oft-used term's definition avoids".

Retrieved 9 May 2017. Dias, Joao; Patnaik, Debasish; Scopa, Enrico; van Bommel, Edwin. " Automating the bank's back office". McKinsey & Company. Retrieved 9 May 2017. Eveleth, Rose. " Will pay vanish? Numerous innovation cheerleaders believe so, however as Rose Eveleth finds, the fact is much more difficult". BBC. Fetched 9 May 2017.

Our cloud based option includes sector top safety and security, minimizing your costs and also giving you assurance. This single platform advertises organic growth through our large collection of open APIs, function rich functionality and also substantial reporting capabilities.

You can find more information about the topic here: Additional info

Sandstone Technology Group

Level 4/123 Walker St,

North Sydney NSW 2060, Australia

+61299117100

https://www.sandstone.com.au/en-au/

info@sandstone.com.au

Postal Address:

PO Box 2011, North Sydney

NSW 2059 AUSTRALIA

https://en.search.wordpress.com/?src=organic&q=digital banking

The Worst Advice We've Ever Heard About Lending Solutions

The earliest kinds of electronic banking trace back to the arrival of ATMs as well as cards introduced in the 1960s. As the web arised in the 1980s with early broadband, electronic networks began to link retailers with vendors and also customers to establish requirements for early online catalogues as well as inventory software application systems.

The renovation of broadband and ecommerce systems in the very early 2000s caused what appeared like the contemporary digital banking world today. The expansion of smart devices with the next years opened up the door for purchases on the move past Automated Teller Machine. Over 60% of consumers now utilize their smart devices as the preferred technique for electronic banking.

This dynamic shapes the basis of customer complete satisfaction, which can be supported with Customer Partnership Monitoring (CRM) software program. Consequently, CRM needs to be integrated into an electronic financial system, because it provides ways for financial institutions to straight communicate with their clients. There is a need for end-to-end consistency as well as for services, maximized on comfort and also user experience.

In order for banks to satisfy consumer needs, they require to keep focusing on enhancing electronic innovation that gives agility, scalability as well as efficiency. A research study conducted in 2015 exposed that 47% of bankers see potential to enhance consumer partnership via digital financial, 44% see it as a way to create competitive advantage, 32% as a channel for new consumer procurement.

Significant advantages of digital financial are: Service performance - Not only do digital systems improve interaction with clients as well as deliver their needs faster, they likewise offer techniques for making interior features a lot more efficient. While banks have actually been at the forefront of electronic innovation at the customer end for decades, they have not entirely embraced all the benefits of middleware to increase performance.

Standard bank processing is expensive, slow as well as prone to human error, according to McKinsey & Company. Counting on people and also paper additionally uses up workplace, which runs up energy and also storage space costs. Digital systems can future reduce prices via the synergies of more qualitative data and faster action to market changes.

Paired with absence of IT integration in between branch and back office employees, this trouble minimizes business effectiveness. By streamlining the confirmation process, it's much easier to execute IT remedies with service software program, leading to even more exact accounting. Financial accuracy is important for banks to follow federal government policies. Enhanced competitiveness - Digital remedies help take care of marketing lists, enabling banks to reach wider markets and also build closer connections with technology savvy consumers.

It's reliable for carrying out customer incentives programs that can improve commitment as well as fulfillment. Greater dexterity - Using automation can accelerate both exterior and inner processes, both of which can enhance customer fulfillment. Adhering to the collapse of financial markets in 2008, an enhanced emphasis was put on threat administration.

Boosted protection - All services large or small face a growing variety of cyber risks that can damage reputations. In February 2016 the Internal Earnings Service revealed it had been hacked the previous year, as did numerous huge tech business. Banks can gain from added layers of security to secure information.

By replacing hand-operated back-office procedures with automated software application remedies, banks can decrease employee mistakes and also quicken processes. This paradigm shift can result in smaller sized functional units as well as permit supervisors to focus on enhancing jobs that require human treatment. Automation minimizes the demand for paper, which certainly winds up taking up room that can be occupied with modern technology.

One method a financial institution can improve its backside service efficiency is to split numerous procedures into three categories: complete computerized partly automated hand-operated jobs It still isn't functional to automate all operations for several economic firms, particularly those that carry out financial testimonials or provide financial investment advice. However the even more a bank can replace troublesome redundant manual tasks with automation, the extra it can focus on concerns that include straight communication with customers.

In addition, electronic cash can be mapped and accounted for a lot more precisely in cases of disagreements. As customers locate a boosting number of acquiring possibilities at their fingertips, there is much less requirement to bring physical money in their pocketbooks. Various other indicators that require for electronic money is growing are highlighted by the usage of peer-to-peer repayment systems such as PayPal as well as the rise of untraceable cryptocurrencies such as bitcoin.

The problem is this innovation is still not universal. Cash circulation expanded in the United States by 42% between 2007 and also 2012, with an average annual growth rate of 7%, according to the BBC. The idea of an all digital money economic climate is no more just a futuristic desire yet it's still unlikely to date physical money in the near future.

ATMs aid banks cut overhanging, especially if they are available at numerous calculated places past branch offices. Emerging kinds of electronic banking are These services improve enhanced technological styles as well as various company models. The choice for financial institutions to include even more electronic solutions in all functional degrees will have a significant effect on their financial stability.

Sharma, Gaurav. " What is Digital Financial?". VentureSkies. Fetched 1 May 2017. Kelman, James (2016 ). The History of Banking: A Comprehensive Referral Resource & Overview. CreateSpace Independent Publishing Platform. ISBN 978-1523248926. Locke, Clayton. " The tempting surge of digital financial". Banking Innovation. Fetched 9 May 2017. Ginovsky, John. " What really is "electronic financial"? Consensus on this oft-used term's meaning eludes".

Gotten 9 May 2017. Dias, Joao; Patnaik, Debasish; Scopa, Enrico; van Bommel, Edwin. " Automating the bank's back office". McKinsey & Company. Recovered 9 May 2017. Eveleth, Rose. " Will pay disappear? Numerous modern technology supporters think so, but as Rose Eveleth discovers, the fact is more complicated". BBC. Recovered 9 May 2017.

Our cloud based remedy includes market prominent security, decreasing your costs and providing you tranquility of mind. This solitary system advertises organic growth via our huge collection of open APIs, attribute abundant performance as well as considerable reporting abilities.

You can discover more details about the subject here: Additional info

Sandstone Technology Group

Level 4/123 Walker St,

North Sydney NSW 2060, Australia

+61299117100

https://www.sandstone.com.au/en-au/

info@sandstone.com.au

Postal Address:

PO Box 2011, North Sydney

NSW 2059 AUSTRALIA

The Biggest Trends In Digital Banking Solutions Companies We've Seen This Year

Our Digital Banking Solutions Ideas

Including a wide variety of devices and also capabilities that cover all facets of these activities, it is currently vital to efficiently operate their digital transformation. It is utilized to take care of all procedures from front and also back workplace for all branches of the network on several channels: Net system, mobile application, ATMs.

On top of its own components, its open design enables connection to software from other distributors. Regardless of the sort of service, the variety of customers and the quantity of deals, a modern core banking system is adaptable sufficient to permit customized setups as well as therefore reply to any kind of certain requirement.

On top of that, they undergo the multiple as well as strict laws, with possibly hefty consequences in case of non-compliance. These pressures all market gamers to rely on a powerful technological base. Thanks to about twenty years of industrial task, has ended up being a world-renowned online. We use extensive services made up of greater than 200 modules that sustain all tasks from back office to front workplace.

Digital Banking Solutions & Platform for Beginners

These last for that reason delight in a multi-channel experience, having the ability to access all banking services on their computer system or on a mobile electronic gadget (phone or tablet). This contributes to improve customers' contentment and assists retaining them, which is important in a circumstance of enhanced competitors. Being a crucial player in the digital banking area, we are devoted to providing financial institutions and also financial organizations with modern-day, effective, reliable and versatile IT tools that can flawlessly meet their demands.

It is finished by expert support in any way phases of the task implementation: analysis, integration, administration, introducing and also after go-live. Furthermore, as a result of progressing market circumstances, our options are constantly being upgraded and upgraded with extra capabilities. 450 specialists function for our Study and also Advancement division to develop software program capable of adjusting to any kind of significant change really swiftly (banking technology).

is widely renowned for its fully integrated software that help banks in constructing a phenomenal multi-channel client experience. In this age where electronic banking improvement is important, having this software application specialist as a companion is vital to move towards operational quality as well as elevate their results. Versatility is among SAB applications' largest advantages; thus, they cover all financial organization lines.

Not known Incorrect Statements About Best Digital Banking Platform In 2020

Out of 577 distinct banks in the Philippines, 450 are country banks that have a broader reach and also spread strategically throughout the country. However, 94% of country financial institutions have no accessibility to an e-payment infrastructure. This indicates most Filipinos lack the methods to obtain less complicated financial gain access to. Additionally, most offered modern technologies as well as repayment services require an updated phone or an excellent wifi connection that is not included in the Filipinos' economic practices.

The representation of banks is swiftly altering. No longer is a financial institution an establishment on Wall Road yet rather an application on my phone. Creating business growth calls for a quick adjustment to this business model. Our remedies resolve this makeover, allowing you to accept new business designs and also specify a modern-day business design.

Welcoming electronic is a lot more than a mobile application, but instead an omni-channel technique. You should map every one of your client's desires and afterwards satisfy them. More youthful clients tend to be sandstone homes 'cashless' as well as wish to move cash quickly with their friends with mobile banking. Other consumers anticipate individualized economic solutions as well as guidance by means of an electronic banking platform.

Best Digital Banking Platform In 2020 Can Be Fun For Everyone

At the heart of this is trusted and safe solutions. The line of separation between competitive financial institutions, consisting of digital indigenous Fintech companies, is so narrow as well as blurring even more each year. As a result of that, banking solution manufacturers can not pay for a security slip. Clients today will rapidly move services with one safety scare.

Our digital as well as application solution experts will then make that roadmap a truth, making and carrying out new electronic remedies. Our end-to-end deals will electronically transform your financial institution, handling threat and also driving earnings.

One of the crucial points when a company introduces a system whether a website or mobile app is opening individual accounts that enable them to be utilized as wallets, accelerating collections and permitting settlements as well as transfers. Financial services Choices currently exist such as BBVA APIs Accounts as well as Home mortgages that mean, With the development of ecommerce and the digitization of culture, has infected all organizations.

How Digital Banking Solutions can Save You Time, Stress, and Money.

This digitization is transforming payment services in all levels of business, from multinationals to tiny as well as medium-sized enterprises down to the micro-SMEs coming from the self-employed. From settlements to companies of services and products to repaying the credit so normal of traditional local shops, there is now a possibility to digitize the "I'll put in on the tab" in a well organized method.

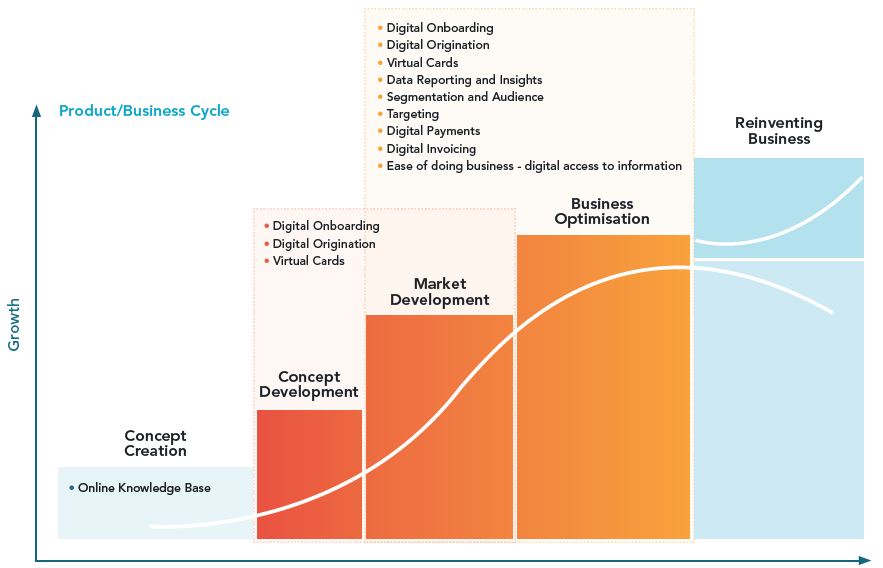

These systems assist by making it less complicated for swiftly as well as firmly - digital banking solutions companies. initially utilizing financial institution cards and afterwards via mobile financial solutions has been a historic obstacle to entrance. The modern technology only started to be accepted by the "majorities" in the phases in the item life process (trendsetters, early adopters, very early bulk and also late bulk) when the early adopters reported that they were safe and secure.

This combination depends upon the opening of an electronic account within BBVA's digital facilities, a substantial point in making sure protection. With this API, a business's clients can open a digital account with low economic danger directly from that business's application or website, without need for third events. And without leaving home.

Indicators on Best Digital Banking Platform In 2020 You Need To Know

Rapid, risk-free and also with simply a few clicks. BBVA's Accounts API aids companies via the use an API integrated into the BBVA setting, facilitating the opening of accounts for customers, staff members and also providers with just a couple of clicks. This includes offering customers the opportunity of connecting a debit card to the account.

When individuals intend to, they initiate a demand and also receive an SMS with a distinct, one-time code, enabling them to activate their brand-new account rapidly and safely. The contract is sent out to the client's e-mail immediately. The new account can be provided utilizing BBVA mobile financial, quizing information of account info, viewing equilibriums, as well as checking and making activities.

Sandstone Technology Group

Level 4/123 Walker St, North Sydney NSW 2060, Australia

+61299117100

https://www.sandstone.com.au/en-au/

info@sandstone.com.au

Postal Address:

PO Box 2011, North Sydney

NSW 2059 AUSTRALIA

Why You Should Forget About Improving Your Sandstone Information

Some Ideas on Digital Banking Solutions & Platform You Need To Know

Featuring a variety of devices and also capabilities that cover all elements of these tasks, it is currently necessary to efficiently run their digital improvement. It is made use of to handle all procedures from front and also back office for all branches of the network on several networks: Web platform, mobile application, ATMs.

In addition to its very own modules, its open architecture allows connection to software application from various other vendors. No matter of the sort of company, the variety of users as well as the quantity of purchases, a modern core banking system is adaptable enough to permit personalized configurations and as a result react to any kind of particular demand.

On top of that, they are subject to the multiple as well as strict guidelines, with possibly heavy effects in situation of non-compliance. These pressures all market gamers to depend on an effective technological base. Many thanks to about two decades of business activity, has actually come to be a world-renowned online. We provide extensive services made up of more than 200 components that sustain all tasks from back workplace to front office.

Little Known Facts About Digital Banking Solutions.

These last therefore enjoy a multi-channel experience, being able to accessibility all banking services on their computer system or on a mobile digital device (phone or tablet). This adds to enhance clients' satisfaction as well as assists maintaining them, which is vital in a circumstance of raised competitors. Being a principal in the electronic banking area, we are committed to offering banks as well as banks with modern-day, effective, reliable as well as flexible IT tools that can perfectly fulfill their demands.

It is completed by professional assistance whatsoever stages of the job implementation: evaluation, assimilation, management, releasing as well as even after go-live. Furthermore, due to evolving market conditions, our remedies are frequently being updated as well as upgraded with extra capabilities. 450 experts help our R & d division to develop software program efficient in adjusting to any kind of considerable change very swiftly (banking software).

is extensively renowned for its fully integrated software program that help financial institutions in building a remarkable multi-channel customer experience. In this age where electronic banking improvement is critical, having this software expert as a companion is vital to relocate in the direction of functional quality and also raise their results. Flexibility is just one of SAB applications' most significant advantages; thus, they cover all financial business lines.

The smart Trick of Best Digital Banking Platform In 2020 That Nobody is Talking About

Out of 577 one-of-a-kind financial institutions in the Philippines, 450 are country banks that have a larger reach and spread tactically throughout the nation. Nonetheless, 94% of country financial institutions have no access to an e-payment infrastructure. This indicates most Filipinos lack the ways to get much easier economic gain access to. Furthermore, most available modern technologies and settlement remedies require an upgraded phone or an excellent wifi link that is not included in the Filipinos' economic routines.

The representation of banks is quickly changing. No longer is a financial institution an institution on Wall Street yet rather an application on my phone. Producing company development requires a fast change to this service model. Our remedies resolve this transformation, enabling you to accept brand-new organization models as well as specify a modern-day organization design.

Accepting digital is a lot more than a mobile application, but instead an omni-channel approach. You need to map all of your consumer's desires and afterwards meet them. Younger customers often tend to be 'cashless' and also wish to move cash promptly with their pals with mobile banking. Various other consumers expect personalized economic solutions and guidance through an on-line banking platform.

The Best Guide To Digital Banking Solutions

At the heart sandstone homes of this is dependable as well as protected services. The line of separation in between competitive financial institutions, consisting of electronic indigenous Fintech firms, is so slim and obscuring more each year. Due to that, banking solution producers can not pay for a security slip. Consumers today will promptly move services with one protection scare.

Our digital and also application solution specialists will certainly after that make that roadmap a truth, developing and also carrying out new electronic services. Our end-to-end deals will digitally change your financial institution, handling risk and also driving profitability.

One of the crucial points when a firm launches a system whether a site or mobile application is opening user accounts that enable them to be used as purses, quickening collections and also allowing repayments and transfers. Financial services Options currently exist such as BBVA APIs Accounts and Home mortgages that mean, With the growth of ecommerce as well as the digitization of culture, has infected all services.

Digital Banking Solutions Things To Know Before You Buy

This digitization is changing repayment services whatsoever levels of business, from multinationals to little and medium-sized ventures to the micro-SMEs coming from the independent. From repayments to suppliers of items as well as solution to paying off the credit history so normal of conventional regional shops, there is now an opportunity to digitize the "I'll put in on the tab" in a well organized means.

These systems assist by making it easier for quickly and securely - digital broker solutions. first using financial institution cards and also after that with mobile banking solutions has been a historic obstacle to entrance. The technology just started to be accepted by the "majorities" in the stages in the product life process (innovators, early adopters, very early majority and late majority) when the early adopters reported that they were safe and secure.

This assimilation depends on the opening of a digital account within BBVA's electronic facilities, a considerable point in making certain safety. With this API, a company's clients can open up a electronic account with low financial danger directly from that business's application or website, without demand for 3rd parties. As well as without leaving home.

Digital Banking Solutions & Platform Things To Know Before You Get This

Rapid, risk-free as well as with just a couple of clicks. BBVA's Accounts API helps firms with the usage an API integrated right into the BBVA environment, facilitating the opening of make up customers, workers and providers with just a few clicks. This consists of offering users the possibility of linking a debit card to the account.

When individuals intend to, they start a request as well as receive an SMS with an unique, single code, allowing them to activate their new account swiftly and also firmly. The contract is sent out to the customer's email automatically. The new account can be provided using BBVA mobile banking, inquiring details of account details, viewing balances, and also checking and also making motions.

Sandstone Technology Group

Level 4/123 Walker St, North Sydney NSW 2060, Australia

+61299117100

https://www.sandstone.com.au/en-au/

info@sandstone.com.au

Postal Address:

PO Box 2011, North Sydney

NSW 2059 AUSTRALIA

7 Things About Transact-online Your Boss Wants To Know

What Does Digital Banking Solutions Mean?

Featuring a large range of devices and capabilities that cover all aspects of these activities, it is currently important to effectively operate their electronic change. It is utilized to handle all operations from front and back office for all branches of the network on numerous channels: Internet platform, mobile application, ATMs.

In addition to its very own components, its open design enables link to software from other providers. Regardless of the sort of company, the number of users and also the volume of purchases, a modern-day core financial system is adaptable sufficient to permit custom-made setups and for that reason react to any certain demand.

Additionally, they are subject to the several as well as strict policies, with potentially hefty effects in situation of non-compliance. These forces all market gamers to rely upon an effective technological base. Thanks to concerning 20 years of industrial task, has actually come to be a world-renowned online. We provide considerable options made up of greater than 200 modules that support all tasks from back office to front workplace.

The 5-Minute Rule for Best Digital Banking Platform In 2020

These last therefore take pleasure in a multi-channel experience, being able to gain access to all banking solutions on their computer or on a mobile electronic tool (phone or tablet). This adds to enhance customers' contentment as well as aids retaining them, which is vital in a situation of raised competition. Being a key player in the electronic financial field, we are devoted to offering banks as well as financial establishments with contemporary, effective, trusted and also versatile IT tools that can flawlessly fulfill their demands.

It is finished by professional support in all stages of the task implementation: evaluation, integration, monitoring, releasing and also also after go-live. Furthermore, due to advancing market circumstances, our services are continuously being updated as well as updated with added capabilities. 450 experts work for our Research study and Growth department to establish software application efficient in adjusting to any kind of significant change extremely swiftly (digital banking solutions companies).

is widely renowned for its completely incorporated software that aid banks in developing a remarkable multi-channel client experience. In this age where electronic banking makeover is important, having this software application professional as a partner is necessary to relocate in the direction of functional quality as well as elevate their end results. Adaptability is just one of SAB applications' biggest advantages; hence, they cover all banking service lines.

The Buzz on Digital Banking Software Solutions - Online Banking Software

Out of 577 unique banks in the Philippines, 450 are rural financial institutions that have a bigger reach and scattered purposefully throughout the nation. However, 94% of rural financial institutions have no accessibility to an e-payment infrastructure. This suggests most Filipinos lack the methods to get less complicated monetary access. In addition, most readily available modern technologies and payment remedies need an upgraded phone or a good wifi link that is not included in the Filipinos' economic habits.

The representation of banks is swiftly altering. No longer is a bank an organization on Wall Road but rather an application on my phone. Producing business development requires a quick adjustment to this business design. Our options address this change, permitting you to accept new business designs and define a modern service design.